Payroll automation is no longer optional for employers in the Philippines in 2026. With stricter compliance requirements from DOLE, BIR, SSS, PhilHealth, and Pag-IBIG, manual payroll processing increases the risk of costly errors, penalties, and employee complaints....

Blog

Welcome to the SuweldoCalculator Blog.

We publish practical guides on salary computation, payroll compliance, taxation, and mandatory employee benefits in the Philippines. Our goal is to help employers, HR professionals, and workers understand how pay, deductions, and labor rules are applied in real situations.

Explore our latest articles covering DOLE regulations, BIR tax rules, final pay requirements, overtime calculations, and payroll best practices for 2026.

Salary Tax Computation in the Philippines: Employer’s Complete 2026 Guide

Salary tax computation and BIR payroll compliance Philippines 2026 Correct salary tax computation is one of the most critical payroll responsibilities of employers in the Philippines. Errors in tax withholding, reporting, or remittance are among the top reasons...

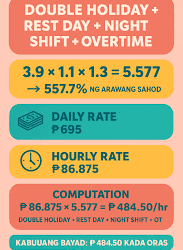

Overtime, Holiday, and Night Differential Pay: A Complete Guide for Employers (Philippines 2026)

Proper computation of overtime, holiday, and night differential pay is essential for payroll compliance in the Philippines. Mistakes in these areas are among the most common reasons employers face DOLE inspections, employee complaints, and penalties. This guide...

Payroll Compliance Guide for Employers in the Philippines (2026)

Payroll compliance in the Philippines is not optional. Employers are legally required to follow Department of Labor and Employment (DOLE), Bureau of Internal Revenue (BIR), and government agency rules when paying employees. Failure to comply with payroll laws is one...

Final Pay Computation in the Philippines: A Complete Guide for Employers (2026)

Final pay, also known as last pay, refers to all remaining compensation an employee is entitled to receive after separation from employment. This applies whether the separation is due to resignation, termination, retirement, or end of contract. Employers in the...

Employee Benefits Employers Are Required to Provide in the Philippines (DOLE Guide)

Mandatory Employee Benefits Employers Must Provide in the Philippines Many employers in the Philippines—especially small businesses and startups—are unaware that employee benefits are not optional. Philippine labor laws clearly define mandatory employee benefits that...

Top Payroll Mistakes Employers Make in the Philippines (DOLE Guide)

Payroll mistakes are one of the most common reasons employers in the Philippines face employee complaints, DOLE inspections, and financial penalties. Most payroll problems don’t happen because employers want to violate the law. They usually happen due to manual...

Why Your Take-Home Pay Is Lower Than Expected in the Philippines

Many Filipino employees are surprised when their take-home pay in the Philippines is much lower than the salary stated in their job offer. For example, you may accept a ₱30,000 monthly salary, but your actual payslip only shows ₱24,000–₱26,000. This is one of the most...

Pag-IBIG MP2 Calculator – Compute Your MP2 Savings & Dividends (2026)

The Pag-IBIG MP2 Calculator helps Filipino savers accurately compute their MP2 savings, annual dividends, and total maturity value. Whether you are saving monthly or through a lump-sum contribution, this calculator gives you a clear estimate of how much your money can...