Keywords: final pay computation Philippines, resigned employee pay, last pay computation, final pay calculator Philippines, salary computation, sweldo calculator, DOLE clearance

💡 What is Final Pay?

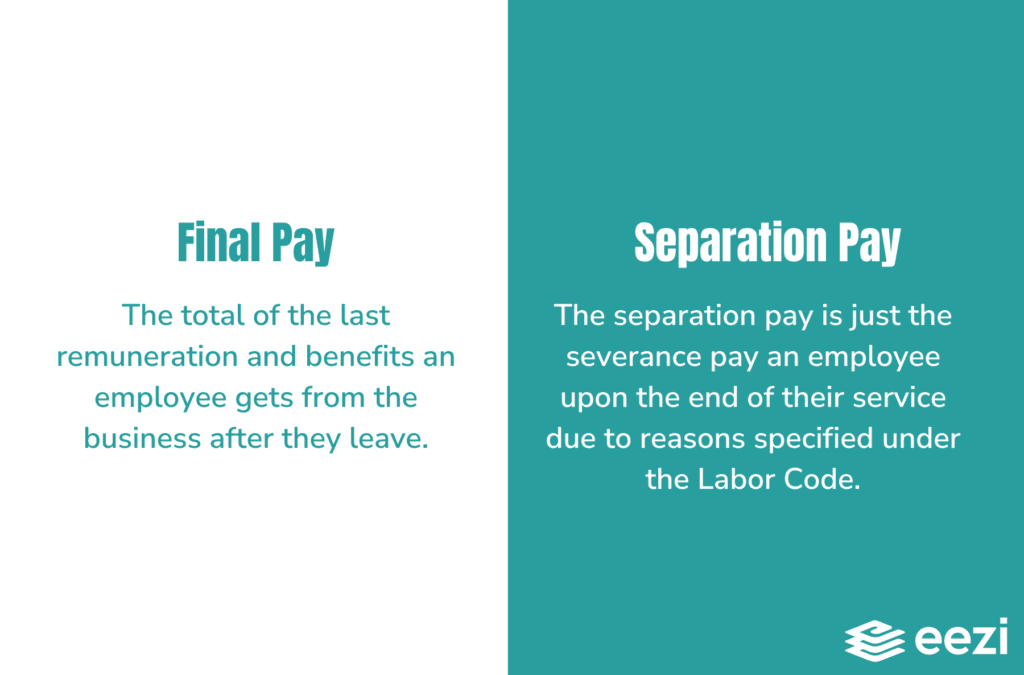

Final pay, also known as last pay, refers to the total amount an employee receives after resigning or being terminated. According to the Department of Labor and Employment (DOLE), employers must release the final pay within 30 days from the employee’s resignation, termination, or end of contract.

Final pay includes all monetary benefits earned up to the employee’s last working day, such as unpaid salary, unused leave credits, and prorated 13th month pay.

To make this easier, you can automatically compute your last pay using the Suweldo Calculator — a free and reliable salary and benefits computation tool for Filipinos.

🧾 Components of Final Pay

Your final pay usually includes the following items:

- Unpaid Salary – Salary earned up to your last working day.

- Pro-rated 13th Month Pay – Computed based on the total months worked during the year.

- Unused Leave Credits – Convertible to cash if allowed by company policy.

- Tax Refund (if applicable) – If you overpaid taxes during the year.

- Deductions – For unreturned property, cash advances, or company loans.

🪜 Step-by-Step: How to Compute Final Pay for Resigned Employees (2025 Example)

Let’s say you resigned effective July 15, 2025, with a monthly salary of ₱20,000.

Step 1: Compute Unpaid Salary

You worked for 15 days in July.

₱20,000 ÷ 26 × 15 = ₱11,538.46

Step 2: Compute Pro-rated 13th Month Pay

You worked for 7 months (January to July).

(₱20,000 × 7) ÷ 12 = ₱11,666.67

Step 3: Convert Unused Leave Credits to Cash

You have 5 unused leave days.

₱20,000 ÷ 26 × 5 = ₱3,846.15

Step 4: Add All Earnings

₱11,538.46 + ₱11,666.67 + ₱3,846.15 = ₱27,051.28

Step 5: Deduct Authorized Deductions

If you have ₱1,000 for unreturned items:

₱27,051.28 − ₱1,000 = ₱26,051.28

✅ Final Pay = ₱26,051.28

You can verify this computation using the Final Pay Calculator Philippines 2025 for an instant and accurate result.

⚖️ DOLE Guidelines on Final Pay

- Employers must release the final pay within 30 days from the employee’s last working day.

- The amount should include all earned monetary benefits.

- Deductions must be lawful and supported by documents.

- Employees are also entitled to receive a Certificate of Employment (COE) and BIR Form 2316 after clearance.

🧠 Quick Tip

Always keep a copy of your resignation letter, payslips, and clearance form to ensure your computation matches the company’s records. For quick and error-free calculations, try the Suweldo Calculator to check your salary, deductions, and final pay.

🏁 Example Summary

| Component | Amount (₱) |

|---|---|

| Unpaid Salary | 11,538.46 |

| 13th Month Pay | 11,666.67 |

| Leave Conversion | 3,846.15 |

| Deductions | (1,000.00) |

| Final Pay | 26,051.28 |

Your final pay depends on how long you’ve worked, your unused leave credits, and any valid deductions.