The 13th month pay is one of the most anticipated benefits for employees in the Philippines — but not everyone realizes that it can be subject to tax under certain conditions. As we enter 2025, the Bureau of Internal Revenue (BIR) continues to enforce updated guidelines on the tax exemption limit for bonuses and 13th month pay.

This guide explains the current BIR tax rules, who are exempted, and how to compute the taxable portion of your 13th month pay.

📘 What Is 13th Month Pay?

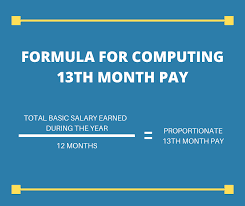

Under Presidential Decree No. 851, employers must provide rank-and-file employees a 13th month pay, equivalent to one-twelfth (1/12) of the total basic salary earned within a calendar year.

Example formula:

13th Month Pay = (Total Basic Salary for the Year ÷ 12)

🧾 BIR Tax Exemption Limit for 2025

As of 2025, the BIR tax exemption limit remains ₱90,000 for 13th month pay and other bonuses combined.

This means:

- If your total 13th month pay and other benefits do not exceed ₱90,000, they are tax-free.

- Any amount beyond ₱90,000 is subject to withholding tax based on the TRAIN Law and BIR Revenue Regulations No. 11-2018.

Example:

If your 13th month pay is ₱100,000 → ₱90,000 is tax-exempt, and ₱10,000 is taxable.

📋 Components Covered by the ₱90,000 Exemption

According to BIR, the exemption applies to the aggregate amount of the following:

- 13th month pay

- Christmas bonus

- Productivity or incentive bonuses

- Other benefits given during the year

🧮 How to Compute Taxable 13th Month Pay

Step 1: Compute total benefits received (13th month + bonuses)

Step 2: Subtract ₱90,000 (tax-exempt limit)

Step 3: The remainder is your taxable amount, which will be added to your annual taxable income

Example Computation:

- Total 13th month pay & bonuses = ₱120,000

- Less exemption = ₱90,000

- Taxable portion = ₱30,000

📅 When Is 13th Month Pay Given?

Employers are required to release the 13th month pay on or before December 24 of every year. Some companies opt to give it in two parts — mid-year (June) and year-end (December).

🧠 Important Reminders for Employers

- Always include 13th month pay in your company’s year-end payroll computation.

- Report taxable portions in the BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld).

- Maintain accurate payroll records for at least three years in case of BIR audit.

- Use automated payroll calculators to avoid tax miscalculations.

🧩 Compute Your 13th Month Pay Instantly

Try our 13th Month Pay Calculator Philippines 2025 to estimate your total benefit and check if your pay exceeds the ₱90,000 tax-free limit.

🏁 Key Takeaway

Your 13th month pay is tax-free up to ₱90,000. Anything beyond that amount becomes taxable according to BIR rules. Always verify your payslip and company computation to ensure correct deductions and compliance with 2025 regulations.

👉 Use our Free 13th Month Pay Calculator to know your net and taxable bonus this year.