Many Filipino employees are surprised when their take-home pay in the Philippines is much lower than the salary stated in their job offer.

For example, you may accept a ₱30,000 monthly salary, but your actual payslip only shows ₱24,000–₱26,000. This is one of the most common salary concerns among employees in the Philippines.

In this guide, we’ll explain why your net pay is lower than your gross salary, how Philippine salary deductions work, and how you can accurately compute your real income in 2025.

Gross Salary vs Take-Home Pay in the Philippines

Before anything else, it’s important to understand the difference:

- Gross Salary – Your salary before deductions

- Take-Home Pay (Net Pay) – The amount you actually receive after deductions

Example:

A gross salary of ₱30,000 does NOT mean you receive ₱30,000 in cash.

Your net pay is reduced by:

- Mandatory government contributions

- Income tax

- Other company deductions

👉 You can estimate your real salary using a Salary Calculator Philippines

Mandatory Salary Deductions in the Philippines

These deductions are required under Philippine labor and tax laws.

1. SSS Contribution (Social Security System)

SSS provides:

- Retirement pension

- Sickness and maternity benefits

- Disability and death benefits

Your SSS contribution increases as your salary increases. While your employer shares part of the contribution, a portion is automatically deducted from your salary.

2. PhilHealth Contribution

PhilHealth contributions are used for:

- Hospitalization

- Medical and health-related expenses

The contribution is:

- Percentage-based

- Shared by employer and employee

- Deducted monthly or semi-monthly

Even if you rarely use PhilHealth, this deduction is mandatory.

3. Pag-IBIG Contribution

Pag-IBIG helps fund:

- Housing loans

- MP2 savings

- Short-term loans

While the Pag-IBIG deduction is relatively small, it still affects your take-home pay.

👉 Learn more about Pag-IBIG contributions here:

Income Tax: The Biggest Reason Your Net Pay Is Lower

Income tax is often the largest deduction from your salary.

Under the TRAIN Law:

- Annual income below ₱250,000 is tax-free

- Income above ₱250,000 is subject to graduated income tax rates

Why your tax may be higher than expected:

- Bonuses may be taxable

- Some allowances are taxable

- Overtime and holiday pay can increase taxable income

👉 To understand how taxes are computed, read:

Other Deductions That Reduce Your Take-Home Pay

Aside from government deductions and income tax, your payslip may include:

- Cash advances or salary loans

- Company cooperative contributions

- HMO dependents

- Late, undertime, or absences

These deductions may seem small individually, but they significantly reduce your net salary.

Why Job Offers Can Be Misleading

Many job offers highlight:

- “₱35,000 monthly package”

- “Inclusive of allowances”

What this usually means:

- Allowances may be taxable

- Gross salary is shown, not net pay

- Actual take-home pay is lower

Before accepting an offer, always ask:

“How much is my estimated net pay after deductions?”

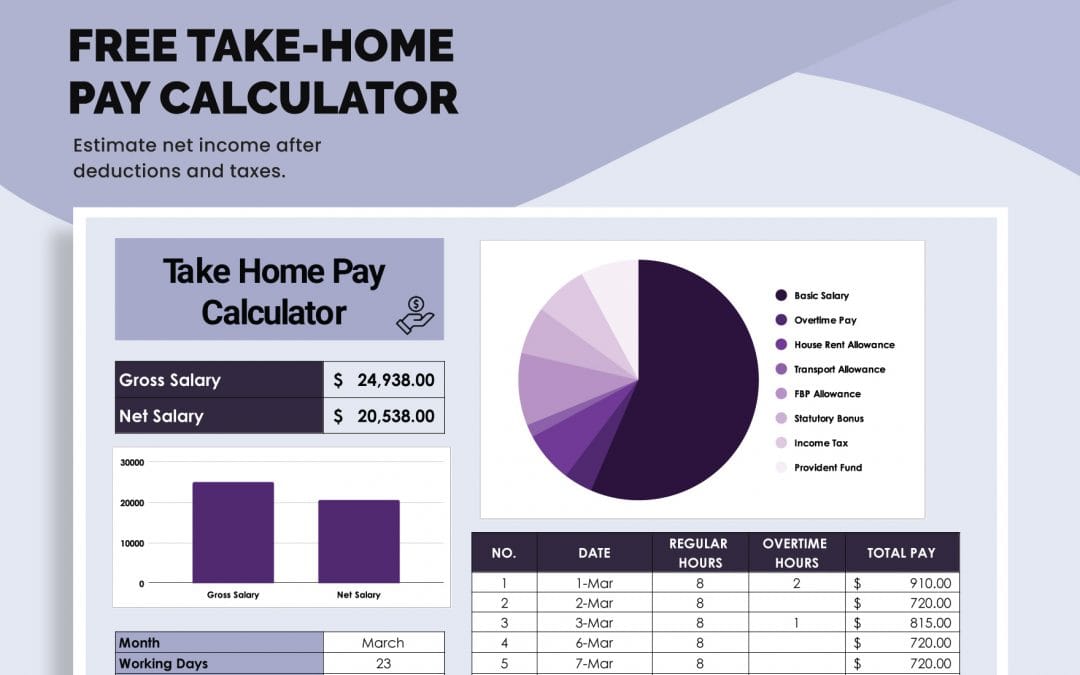

How to Accurately Compute Your Take-Home Pay

The best way to avoid salary surprises is to calculate before signing a contract.

Use online calculators to:

- Compute SSS, PhilHealth, and Pag-IBIG

- Estimate income tax

- See your real monthly take-home pay

👉 Try the free Philippine salary calculator:

How to Increase Your Take-Home Pay (Legally)

While you can’t remove mandatory deductions, you can still improve your net income:

- Negotiate based on net salary, not gross

- Optimize non-taxable benefits

- Understand which allowances are taxable

- Consider savings options like Pag-IBIG MP2

👉 Compare MP2 with other options here:

Final Thoughts

Your salary isn’t disappearing—it’s being deducted according to Philippine laws.

Understanding why your take-home pay is lower than expected in the Philippines helps you:

- Budget more effectively

- Avoid frustration

- Make smarter career decisions

Always focus on net pay, not just the headline salary.