Understanding how to compute employee payroll correctly is essential for every employer in the Philippines. In 2025, with updated contribution rates and digital tools available, payroll computation has become simpler — but accuracy and compliance are still key.

This guide will help you calculate salaries, deductions, and benefits efficiently while following the latest government regulations.

📋 What Is Payroll Computation?

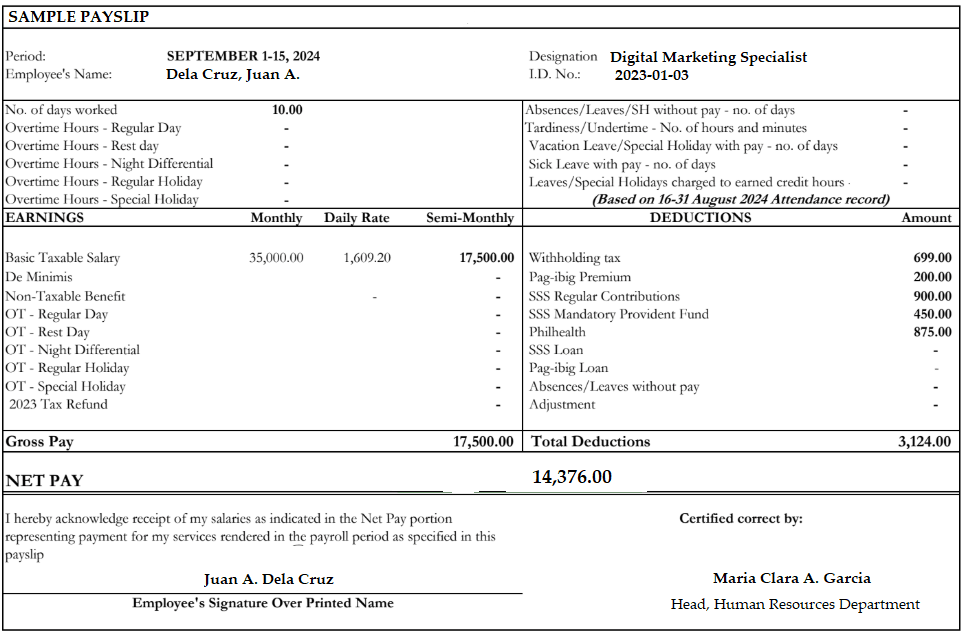

Payroll computation is the process of calculating an employee’s total earnings and mandatory deductions for a specific pay period. It ensures every worker receives their correct net pay, including overtime, leave, and government contributions.

🧮 Payroll Formula

Here’s the basic payroll computation formula used by most employers in the Philippines:

Net Pay = Basic Salary + Allowances + Overtime – Deductions (SSS, PhilHealth, Pag-IBIG, Withholding Tax, Late/Absences)

📅 Payroll Components Explained

- Basic Salary – The employee’s fixed pay based on monthly or daily rates.

- Overtime Pay – Extra pay for work rendered beyond 8 hours or on rest days/holidays.

- Allowances – Non-taxable benefits like transportation, meal, or communication allowance (within limits).

- Government Contributions – Mandatory deductions for SSS, PhilHealth, and Pag-IBIG.

- Withholding Tax – Based on the BIR income tax table (as updated for 2025).

- Other Deductions – Includes late or absent penalties, cash advances, or company loans.

💰 Step-by-Step Payroll Computation (Example)

Scenario:

- Basic Monthly Salary: ₱25,000

- Overtime Pay: ₱1,500

- SSS Contribution: ₱1,125

- PhilHealth Contribution: ₱450

- Pag-IBIG Contribution: ₱100

- Tax Withheld: ₱1,200

Computation:

Total Pay = ₱25,000 + ₱1,500 = ₱26,500

Total Deductions = ₱1,125 + ₱450 + ₱100 + ₱1,200 = ₱2,875

Net Pay = ₱26,500 – ₱2,875 = ₱23,625

🧠 Payroll Computation Tips for 2025

- ✅ Use updated SSS, PhilHealth, and Pag-IBIG rates. Check for new government circulars every January.

- ✅ Automate your payroll system. Try free calculators or HR software to avoid errors.

- ✅ Keep accurate attendance and leave records. This ensures fair computation of pay and deductions.

- ✅ Always issue payslips. Employees must receive a breakdown of their gross and net pay.

📥 Free Payroll Computation Tool

You can simplify this process using our free Payroll Calculator Philippines 2025.

It automatically computes net pay, deductions, and take-home salary — perfect for small businesses and HR teams.

📑 Common Payroll Mistakes to Avoid

- ❌ Forgetting to update contribution tables annually

- ❌ Miscomputing prorated salaries for new hires or resignations

- ❌ Not including overtime or holiday pay

- ❌ Incorrect tax bracket application

🏁 Key Takeaway

Payroll computation is not just about numbers — it’s about compliance, transparency, and trust. With the right tools and knowledge, you can ensure your employees are paid correctly and your business stays compliant with DOLE and BIR rules.

👉 Try our Salary and Payroll Calculator today and make payroll processing effortless in 2025.