Managing your finances starts with knowing your exact take-home pay. Many employees in the Philippines often wonder how much of their salary goes to deductions like SSS, PhilHealth, and Pag-IBIG. The Suweldo Calculator is a free and easy-to-use salary calculator in the Philippines that helps you compute your net pay online in just a few clicks.

This guide explains the features of the tool, provides a step-by-step tutorial, and shows why it’s helpful for workers and freelancers.

Why Use a Salary Calculator in the Philippines?

Understanding your sweldo or salary is important because it helps you:

- Plan your monthly budget

- Check if your payslip is accurate

- Estimate deductions like SSS, PhilHealth, and Pag-IBIG

- See how overtime, holiday pay, or night differential affect your income

With the Suweldo Calculator, you don’t need to do manual computations. Everything is automated and accurate.

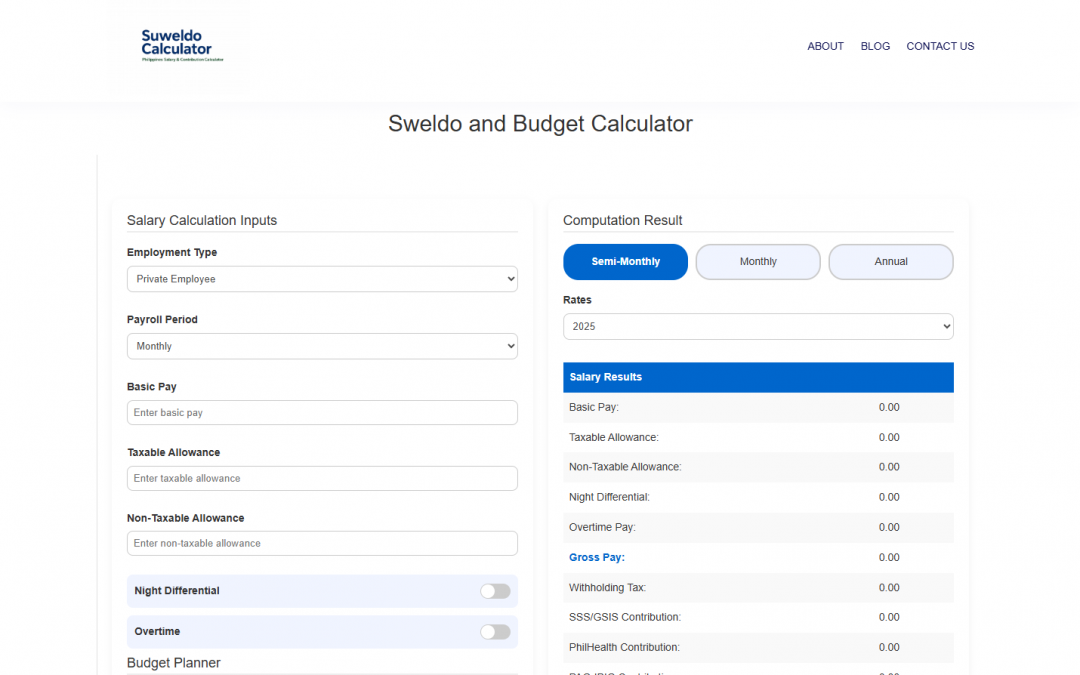

Features of the Suweldo Calculator

- Net Pay Computation

Instantly shows how much you’ll take home after deductions. - Government Deductions

Automatically includes SSS, PhilHealth, and Pag-IBIG contributions. - Tax Calculation

Calculates withholding tax based on BIR rules. - Overtime, Holiday, and Night Differential Pay

Lets you add extra pay so you can see how it affects your total income. - User-Friendly Design

Accessible on both desktop and mobile devices, so you can compute net pay online anytime.

Step-by-Step Guide to Using the Suweldo Calculator

Step 1: Open the Tool

Visit Suweldo Calculator on your browser.

Step 2: Enter Your Basic Information

Type in your monthly or daily salary. You can also select if you are paid per month, per day, or per hour.

Step 3: Input Deductions and Contributions

The calculator automatically applies SSS, PhilHealth, and Pag-IBIG contributions based on your salary bracket.

Step 4: Add Extra Pay

If you work overtime, on holidays, or during night shifts, enter the hours worked. The tool will compute your additional pay.

Step 5: View Your Net Pay

Click Compute to see your take-home pay. The tool shows a detailed breakdown of gross salary, contributions, taxes, and final net pay.

Example Computation

If your monthly salary is ₱25,000:

- Gross Pay: ₱25,000

- SSS, PhilHealth, Pag-IBIG: automatically deducted

- Withholding Tax: computed using the BIR tax table

- Net Pay: instantly displayed

This transparency helps you check if your payslip matches your expected salary.

Why Suweldo Calculator is Useful

Unlike manual computation or confusing spreadsheets, the Suweldo Calculator gives accurate results in seconds.

- For employees: Know your correct take-home pay.

- For freelancers: Estimate contributions and taxes.

- For employers: Quickly compute payroll for staff.

As a result, this tool saves time and avoids mistakes.

Final Thoughts

The Suweldo Calculator is more than just a simple sweldo calculator. It is a powerful yet easy-to-use salary calculator in the Philippines that helps workers understand their income better.

Try the tool now and compute your net pay online with confidence.