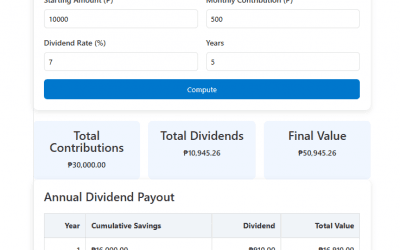

What Is Pag-IBIG MP2 Savings Program The Pag-IBIG MP2 Savings Program is a voluntary savings scheme offered by the Home Development Mutual Fund (HDMF). It allows members to grow their money faster through tax-free dividends that are higher than regular savings. MP2 is...

Blog

Welcome to the SuweldoCalculator Blog.

We publish practical guides on salary computation, payroll compliance, taxation, and mandatory employee benefits in the Philippines. Our goal is to help employers, HR professionals, and workers understand how pay, deductions, and labor rules are applied in real situations.

Explore our latest articles covering DOLE regulations, BIR tax rules, final pay requirements, overtime calculations, and payroll best practices for 2026.

🧮 Tax Calculator Philippines 2025 – Compute Your Salary Tax Accurately

Meta Title:Tax Calculator Philippines 2025 – Accurate Income & Salary Tax Computation Meta Description:Use our free Tax Calculator Philippines 2025 to compute your salary tax, SSS, PhilHealth, and Pag-IBIG deductions instantly. See your net pay and take-home...

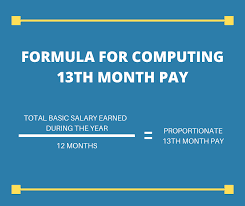

💰 13th Month Pay Tax Rules According to BIR 2025

The 13th month pay is one of the most anticipated benefits for employees in the Philippines — but not everyone realizes that it can be subject to tax under certain conditions. As we enter 2025, the Bureau of Internal Revenue (BIR) continues to enforce updated...

💸 Back Pay Calculator: How Much Will You Get When You Resign? (2025)

Planning to resign soon? Before you submit that resignation letter, it’s important to know how much back pay you’ll receive. In the Philippines, back pay (also known as final pay) includes all the money owed to you by your employer when you leave a company. This...

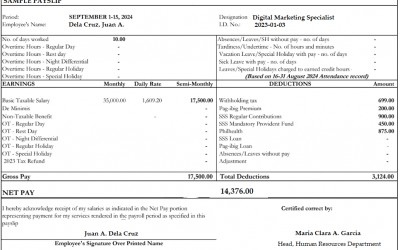

💼 Payroll Computation: Complete Guide for Employers in 2025

Understanding how to compute employee payroll correctly is essential for every employer in the Philippines. In 2025, with updated contribution rates and digital tools available, payroll computation has become simpler — but accuracy and compliance are still key. This...

🧮 13th Month Pay Calculator Excel Template Free Download (2025)

If you’re an HR officer, business owner, or employee who wants to easily compute 13th month pay, you’re in the right place! We’ve prepared a free Excel template that automatically calculates your 13th month pay based on your total basic salary — no need to do it...

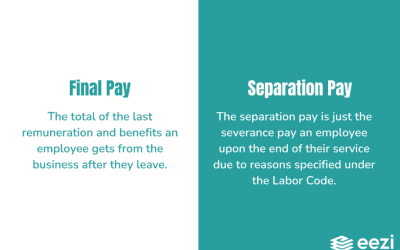

💰 Final Pay Computation for Resigned Employees in the Philippines (2025 Guide)

Keywords: final pay computation Philippines, resigned employee pay, last pay computation, final pay calculator Philippines, salary computation, sweldo calculator, DOLE clearance 💡 What is Final Pay? Final pay, also known as last pay, refers to the total amount an...

🧮 How to Compute 13th Month Pay with Absences (Step-by-Step 2025)

Keywords: 13th month pay calculator, 13th month pay computation 2025, how to compute 13th month pay with absences, salary computation Philippines, 13th month pay formula, 13th month pay law 💡 What is 13th Month Pay? The 13th month pay is a mandatory benefit given to...

Salary & Tax Calculator Philippines 2025 | Free Online Sweldo Calculator

Are you looking for a quick and reliable way to calculate your net pay in the Philippines for 2025? Our Free Online Salary & Tax Calculator helps you instantly determine your take-home pay after tax, SSS, PhilHealth, and Pag-IBIG deductions. This tool is updated...