Understanding the minimum wage in the Philippines 2025 is crucial for both employees and employers. It determines fair compensation, affects SSS, PhilHealth, and Pag-IBIG contributions, and helps calculate take-home pay. This guide provides the latest regional wage rates and explains their impact on net salary.

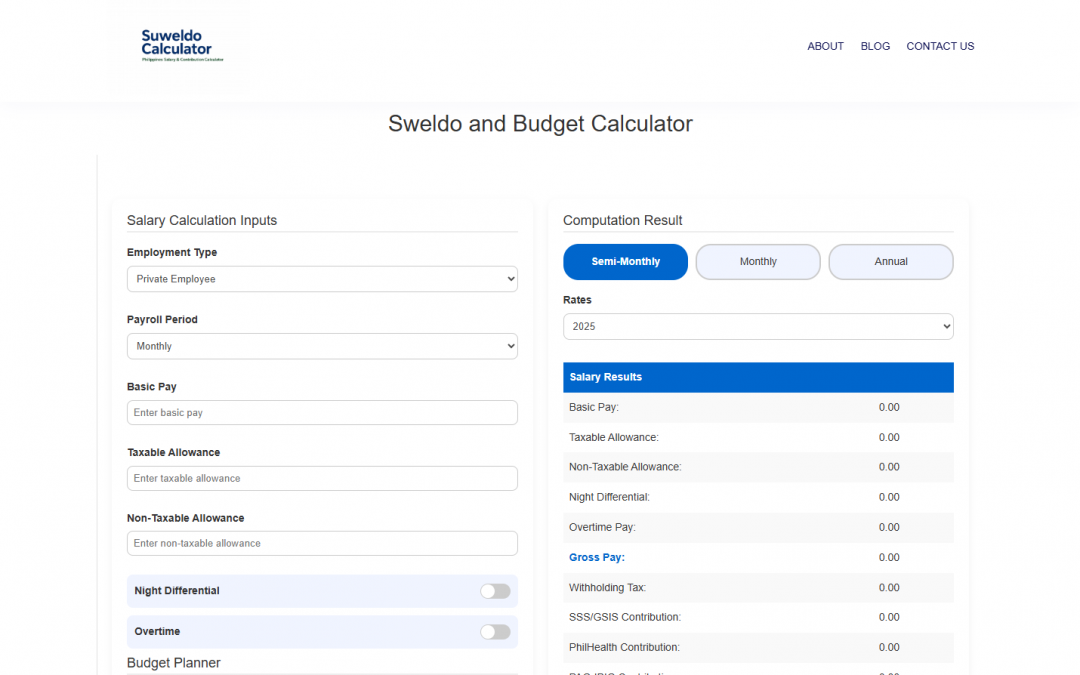

Try the Sweldo Calculator

Compute your salary, deductions, and Pag-IBIG contributions in real time:

Why Minimum Wage Matters

The minimum wage sets the legal baseline for compensation. Employees cannot be paid less than the rates set by the regional wage boards. Knowing your region’s wage ensures you receive fair pay and can plan your finances accurately.

2025 Minimum Wage Rates by Region

| Region | Minimum Daily Wage (₱) | Notes |

|---|---|---|

| NCR | 570 | Metro Manila, highest regional wage |

| CAR | 400 | Cordillera Administrative Region |

| Region I (Ilocos) | 400 | Ilocos Norte, Ilocos Sur, La Union, Pangasinan |

| Region II (Cagayan Valley) | 400 | Batanes, Cagayan, Isabela, Nueva Vizcaya, Quirino |

| Region III (Central Luzon) | 450 | Aurora, Bataan, Bulacan, Nueva Ecija, Pampanga, Tarlac, Zambales |

| Region IV-A (CALABARZON) | 470 | Cavite, Laguna, Batangas, Rizal, Quezon |

| Region IV-B (MIMAROPA) | 400 | Mindoro, Marinduque, Romblon, Palawan |

| Region V (Bicol) | 400 | Albay, Camarines Norte, Camarines Sur, Catanduanes, Masbate, Sorsogon |

| Region VI (Western Visayas) | 405 | Aklan, Antique, Capiz, Guimaras, Iloilo, Negros Occidental |

| Region VII (Central Visayas) | 410 | Bohol, Cebu, Negros Oriental, Siquijor |

| Region VIII (Eastern Visayas) | 400 | Biliran, Leyte, Southern Leyte, Samar, Northern Samar, Eastern Samar |

| Region IX (Zamboanga Peninsula) | 405 | Zamboanga del Norte, Zamboanga del Sur, Zamboanga Sibugay |

| Region X (Northern Mindanao) | 400 | Bukidnon, Camiguin, Lanao del Norte, Misamis Occidental, Misamis Oriental |

| Region XI (Davao Region) | 410 | Davao del Norte, Davao del Sur, Davao Oriental, Davao de Oro, Davao Occidental |

| Region XII (SOCCSKSARGEN) | 400 | Cotabato, Sarangani, South Cotabato, Sultan Kudarat |

| Region XIII (Caraga) | 400 | Agusan del Norte, Agusan del Sur, Surigao del Norte, Surigao del Sur, Dinagat Islands |

| BARMM | 400 | Bangsamoro Autonomous Region in Muslim Mindanao |

Try the Sweldo Calculator

Compute your salary, deductions, and Pag-IBIG contributions in real time:

How Regional Minimum Wage Affects Contributions and Net Salary

Your take-home pay depends on your gross salary and mandatory deductions. The minimum wage directly impacts:

- SSS Contributions: Higher wages mean higher SSS deductions.

- PhilHealth Premiums: Calculated as a percentage of gross income.

- Pag-IBIG Contributions: A fixed percentage applies, but wage increases may affect voluntary contributions.

- Taxable Income: Minimum wage changes influence withholding tax calculations for employees earning above the non-taxable threshold.

Example:

An employee in NCR earning ₱570/day will have higher contributions than an employee in Region II earning ₱400/day. Consequently, net salary differs even before other allowances or bonuses.

Why Knowing Your Regional Minimum Wage Matters

- Ensures you are legally compensated

- Helps budget and plan your monthly expenses

- Provides clarity when negotiating with employers or checking payslips

- Helps freelancers or part-time workers estimate fair compensation

For official updates, visit the Department of Labor and Employment (DOLE) website. You can also try our Suweldo Calculator to see your net pay based on regional minimum wage.

Final Thoughts

The minimum wage in the Philippines 2025 varies by region and is regulated by regional wage boards. Being informed ensures employees receive proper compensation, understand deductions, and plan finances effectively. Always check your region’s rate to ensure your salary aligns with legal standards.