The Pag-IBIG Fund (HDMF) updated its contribution schedule starting February 2024, which continues in 2026. The maximum fund salary (MFS) has been raised from ₱5,000 to ₱10,000. This means higher maximum contributions for both employers and employees.

Employers should ensure Pag-IBIG contributions are correctly included as part of overall payroll compliance in the Philippines

💡 To make calculations easier, you can use the free Suweldo Calculator to compute your Pag-IBIG contribution instantly.

Try the Sweldo Calculator

Compute your salary, deductions, and Pag-IBIG contributions in real time:

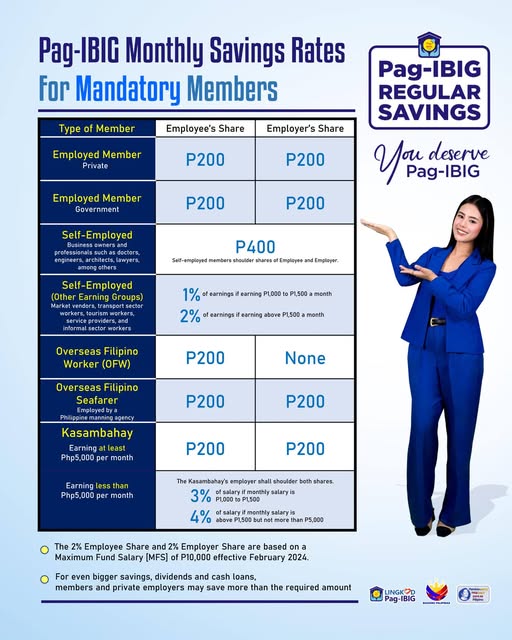

Pag-IBIG Contribution Table 2026

| Monthly Salary / Fund Salary (MFS) | Employee Share | Employer Share | Total Contribution |

|---|---|---|---|

| ₱1,500 and below | 1.0% | 2.0% | 3.0% |

| Over ₱1,500 up to ₱10,000 (MFS cap) | 2.0% | 2.0% | 4.0% |

| Above ₱10,000 (capped) | ₱200 (2% of ₱10,000) | ₱200 (2% of ₱10,000) | ₱400 (capped) |

Employers should also ensure Pag-IBIG deductions are reflected correctly in income tax computation.

Notes:

- Contributions are based only up to ₱10,000 salary (MFS cap).

- Salaries above ₱10,000 are capped at ₱200 employee + ₱200 employer = ₱400 total.

- Salaries ₱1,500 and below only require 1% employee contribution.

Examples of Pag-IBIG Contribution Computation

- Salary = ₱6,500

- Employee: ₱130

- Employer: ₱130

- Total = ₱260

- Salary = ₱15,000

- Capped at ₱10,000 → Employee: ₱200 | Employer: ₱200

- Total = ₱400

- Salary = ₱1,200

- Employee: ₱12

- Employer: ₱24

- Total = ₱36

👉 Instead of computing these manually, you can try the Suweldo Calculator to save time.

FAQs on Pag-IBIG Contribution 2026

1. Who pays the Pag-IBIG contribution?

For employed members, both employer and employee share the contribution. For self-employed or voluntary members, the individual pays the full amount.

2. Why is the rate lower (1%) for salaries ≤ ₱1,500?

This is to give relief to minimum-wage earners. Employers still contribute 2% in this case.

3. What is the maximum contribution in 2026?

Both employee and employer share ₱200 each (₱400 total) since the maximum salary base is ₱10,000.

4. What about self-employed or voluntary contributors?

They usually pay both shares (employee + employer), which is 4% if income exceeds ₱1,500, capped at ₱400.

5. When should employers remit Pag-IBIG contributions?

Employers should remit on or before the 10th day of the following month. Late payments may incur penalties.

6. Will the rates change again after 2026?

No official announcement has been made, but any changes will require a new HDMF circular.